IREP Credit Capital is a Non-Deposit taking NBFC headquartered in Mumbai offering secured business loans to MSMEs in tier 2+ towns.

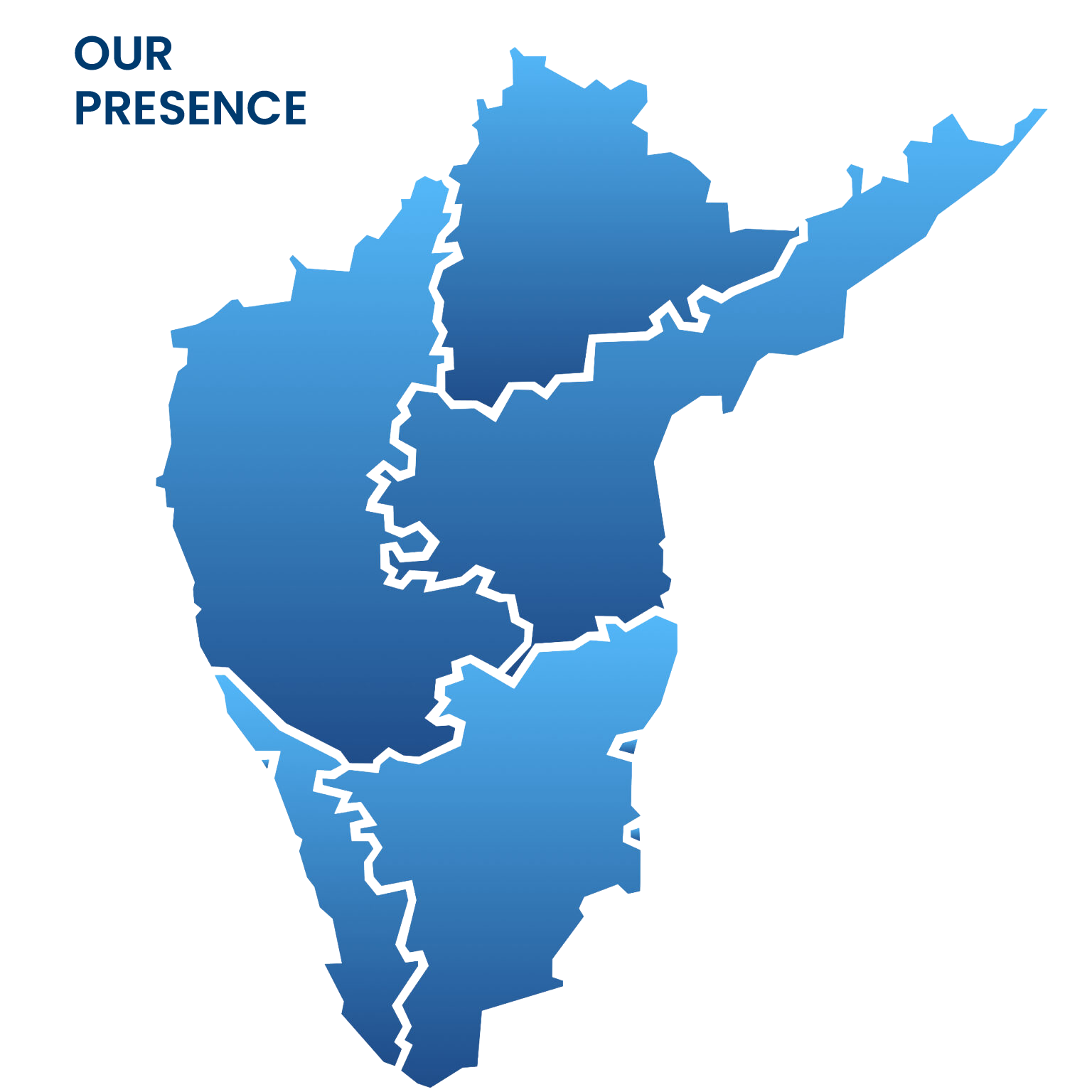

IREP has established itself as a trusted lender in the retail lending space through its tailormade credit solutions to local entrepreneurs in the southern states of Andhra Pradesh, Telangana and Karnataka. IREP’s core offering is the IREP Secured Business Loan that is specifically crafted to cater to the immediate financial needs of relatively smaller sized businesses irrespective of the industry in which they operate. With a focus on quick, sustainable credit and last mile reach, IREP’s loans are targeted towards the largely underserved semi-urban and rural areas of the country’s financial system in order to empower local entrepreneurs realize their financial goals and make them ‘Atmanirbhar’. IREP’s long-term vision is to establish itself as a one-stop-shop for hassle-free credit solutions designed to meet the financial requirements of MSMEs.

Our Story So Far

11,500+

Borrowers

₹ 500 cr +

AUM

3

States

93

Branches

Andhra Pradesh: 43 Branch Offices

Karnataka: 29 Branch Offices

Telangana: 21 Branch Offices

OUR OFFERINGS

IREP Secured Business Loan

IREP’s loans aim to ensure access to timely and adequate credit for the underserved groups keeping in mind the larger goal of financial inclusion. IREP's Secured Business Loans seek to develop a culture of empowerment and self-dependence, among the MSMEs in these untapped rural and semi-urban segments of South India. IREP strives to continuously educate its customers to adopt a business mindset driven on the principle of sustainable development in a cost-effective manner.

- Collateral backed business loans

- Catering to MSMEs in Tier 2+ towns

- Ticket size ranging from INR 3 to 25 Lakh

- Easy repayment options with up to 10-year tenors

- Simplified eligibility and documentation process

- Registered mortgage in the form of MODT

Our Network

Board Of Directors

Amol Jain

Investor Director

Amol is a Partner and member of the VIXAR investment advisory team. He has been with the Firm since its establishment in 2014.

Amol was a Managing Director with the Texas Pacific Group between 2005 and 2014 and helped build the TPG India franchise. At TPG, he led investments into Shriram Transport, Shriram City Union Finance, and Vishal Retail, which was the first distressed buyout transaction executed by a financial sponsor in India.

Prior to joining TPG, Amol worked at DSP Merrill Lynch between 1999 and 2005, where he led the Financial Sponsors group and oversaw marquee private equity transactions including ICICI Ventures’ investment in Tata Infomedia and TPG’s investment in Matrix Labs. Amol began his career at IL&FS in 1996.

Amol holds an undergraduate degree in Electrical Engineering from IIT Bombay and a graduate degree in Management from IIM Ahmedabad.

Amol Jain is on the board of Sterling Hospitals, SEWA Grih Rin Limited, Daignostix and Bloombay Enterprises (The Belgian Waffle Co).

Vishal Thakkar

Investor Director

Vishal is a member of the VIXAR investment advisory team. He has been with the Firm since 2016.

Vishal worked with the Boston Consulting Group between 2014 and 2016, where he advised clients in the financial services and IT services industries on growth strategy, performance improvement, and post-merger integration.

Vishal holds an undergraduate degree in Electronics and Telecommunication from VESIT Mumbai, where he ranked first in his department and a graduate degree in Management from IIM Calcutta, where he ranked fifth in his cohort.

Vishal is also on the board of SEWA Grih Rin Limited.

Ashik Siroya

Investor Director

Ashik is a SVP and member of the VIXAR investment advisory team. He has been with the Firm since 2024.

Ashik was an Investment Director at CVC Capital Partners India and was part of the Financial Services sector coverage team.

Before CVC, Ashik co-led the Financial Services vertical at Arpwood Capital, a boutique M&A advisory firm, from 2016 to 2024. In this role, he advised on several large-ticket M&A transactions, including the merger of Fincare SFB with AU SFB, HDFC with HDFC Bank, Gruh Finance with Bandhan Bank, as well as the acquisitions of DHFL by Piramal Capital (under IBC), Fortis by IHH, Marsh India by MMC, and Ashirvad Pipes by Aliaxis.

Earlier in his career, Ashik worked at Reliance Industries, Jamnagar Refining unit from 2012 to 2014.

Ashik holds an undergraduate degree in Mechanical Engineering from NIT Nagpur and a graduate degree in Management from IIM Calcutta.

Ashik is also on the board of Bloombay Enterprises (The Belgian Waffle Co).

Pramod Dubey

Managing Director & CEO

Pramod is a seasoned banking leader with 24+ years of experience at ICICI Bank, with a strong track record of scaling up and owning large P&Ls. He progressed from Deputy Branch Manager to senior leadership roles across field and central functions, gaining extensive exposure across multiple geographies.

He served as Head of Operations in his last role at ICICI Bank, overseeing a pan-India network of 368 units and managing balance sheets with a deposit book of 13 lakh crore and a loan book of 12 lakh crore, reflecting strong operational governance and execution capabilities.

Between 2018 and 2023, Pramod led the Rural & Agri Business as Group Product Head, with full P&L responsibility for a 91,000 crore loan portfolio, distributed through 6,000+ branches across 23 states, driving scale, profitability, and portfolio quality.

He has also served as Zonal Head and Regional Head, managing balance sheets exceeding 11,000 crore across multiple states and leading large branch networks.

His last stint was on the Board as Executive Director at Utkarsh Small Finance Bank (1,100+ branches), managing a 23,000 crore deposit book and a 19,000 crore loan book. He held responsibility for P&L ownership and business development across Microfinance, MSME LAP, and Affordable Housing, along with leadership oversight of credit, collections, and analytics, strengthening risk management and sustainable growth.

Pramod has served on the boards of regulated financial institutions and financial market infrastructure entities. An alumnus of FMS, Banaras Hindu University, he brings a leadership approach focused on scalable growth, strong risk management, governance, and long-term value creation for all stakeholders.

Past Experience

Our Leadership Team

Alok Bahl

Chief Business Officer

Alok is a Mortgage expert with leadership roles since 2002 having pan India exposure of micro markets.

He has Built distribution platform multiple times over last 27 years at ICICI Bank, HSBC, IndusInd Bank, Piramal Finance and DHFL Group.

Set up & built Mortgage business from Zero to monthly run rate of ~300 cr at Piramal Finance in a span of 24 months, 5x growth in outbound home loans in 1st full year of operations at IndusInd Bank & Handled a team of 2000+ direct + indirect reportees and AUM of ~ 9,000 cr.

Alok has an enriching experience setting up distribution for low ticket HL and LAP in DHFL and Piramal Group. He has handled Sales as well as Collection for micro markets.

He has demonstrated capabilities with profitability focus keeping in mind yields, productivity, manpower planning & customer acquisition strategies.

Past Experience

Mahavir Agrawal

Chief Risk Officer

Mahavir has been in leadership roles at ICICI Bank & Yes Bank for almost a decade each, overseeing Credit & Risk.

He has last served as Yes Bank's Head of Credit for retail, rural and SME segments. He has also chaired credit committees during his stint at Yes Bank.

Mahavir has been the National Credit Head for SME loans at ICICI Bank.

Started banking career with Bank of Baroda, managing Commercial & Institutional Credit in their zonal office for 5 years.

He is a certified Chartered Accountant & Bachelor of Law, along with CAIIB as other academic qualification.

Past Experience

Ramachandran N

Chief Collections Officer

Ram has been National Collections Manager in HDFC Bank and Chief Collections Officer of Muthoot Group & SBFC Finance.

He has an enriching experience of managing ~84,000 cr loan book with ~1400 resources, 900 agencies & 850 tele callers at HDFC Bank for retail assets (secured, unsecured, vehicle loans & credit cards) for 17 years.

Ram has built collections & legal function from scratch at SBFC Finance (MSME finance). He has also constructed recovery models & led collections at Muthoot Group (home, vehicle, business and personal loans) with a team of 6 national heads and 500 resources.

He has an Executive Education degree from IIM Ahmedabad.

Past Experience

Bhavesh Patel

Chief Operating Officer

Bhavesh has 23 years of experience with ICICI Bank, serving as Head of Retail Loan Operations pan India since 2010.

He has managed 250+ retail loan branches & 4 centralised units with a 5000+ workforce across segments including mortgage, vehicle, business, personal & consumer finance.

Bhavesh has also led companywide standardisation of operations process at Sitara Housing within 12 months.

He has also had a short stint at Jio Financial Services to set up an operations system for a new NBFC business. He has built operations expertise with 9 years at Gujarat Lease Financing.

Focus for Bhavesh has always been customer service, streamlining processes with governance & efficiency.

Past Experience

Ashok Mali

Chief Technology Officer

Ashok has 2 decades of experience with almost a decade strengthening the base at Tata Capital (2008 to 2017), to being CIO in Piramal Housing (2017–2021), to CIO in Tata Capital Housing (2022–2025).

At Tata Capital Housing, Ashok led strategic transformation by implementing Retail BRE, digitising Construction Finance LOS, Asset Monitoring Platform, stabilisation of FinnOne LOS, LMS platforms & automated various processes for regulatory compliance.

He has successfully directed the Pinnacle Program at Piramal Finance across LOS to LMS & GL dashboards, leading to a cost savings of 22 cr for construction finance business.

BE in Chemical Engineering, MBA from Mumbai University, executive education from IIM Ahmedabad & XLRI Jamshedpur, along with PMP, ITIL & Six Sigma Green Belt certification.

Past Experience

Prateek Jain

Chief Human Resources Officer

Prateek is a seasoned HR leader for the BFSI sector across HR Business Partnering, Talent Acquisition, and Organizational Effectiveness.

He has a strong track record of supporting high-growth, multi-geography operations, with deep exposure to West and South Indian markets.

Prateek has worked closely with leadership teams on talent and succession planning, leadership capability building, performance management, and employee engagement, with a practical understanding of organizational dynamics in fast-scaling environments.

He is known for building scalable and execution-oriented HR frameworks that enable productivity, governance, and culture stability during growth phases.

Previous stint was with IndusInd Bank for over 9 years, leading HRBP and talent initiatives across key business verticals and geographies, managed HR interventions for a manpower base of up to 8,000 employees.

Past Experience

Srimoyee Kar

Chief Treasury Officer

Srimoyee is a Chartered Accountant by qualification, with Treasury being her forte for the past 2 decades.

She has been one of the early members to set up the entire treasury desk at IIFL, from policies to SOPs to establishing relationships with 28 Public & Private Sector Banks. 20x growth (~ 14,000 cr) was facilitated from Mutual Funds and Bank during her stint at IIFL. Also, she has supported Merrill Lynch in setting up a treasury function for the NBFC business.

She specialises in sourcing funds through various channels including large partnerships via co-lending and business correspondent models, along with other strategic initiatives.

She has extensive experience in end-to-end engagement with all leading credit rating agencies in India, including successful closure of multiple, complex, and varied rating exercises across products, structures, and market cycles.

Srimoyee is featured in India's Influential Women in Fixed Income (March 2025 edition) by Debt Circle & 128 Prominent Women in Bombay Stock Exchanges Brokers' Forum (BBF) (April 2023 edition).

Past Experience

Archanaa Jayaraman

Chief Financial Officer

Archanaa is an Investment Banker turned CFO with over 10 years of experience advising NBFCs.

Some of her clients with unique deals and one-of-a-kind transactions include (in the order of recency) Sitara Housing, Ummeed Housing, Profectus Capital, SK Finance, Kogta Finance, Vistaar Finance, Star Health (multiple rounds), UTI AMC, Ujjivan Small Finance Bank, Kotak Mahindra Bank, SBI General Insurance, Samunnati Finance, Varthana Finance, Credit Access Grameen, SBI Life Insurance, and AU Finance.

She has covered the Indian Financial Services (FS) sector across M&A, Private Equity, and Capital Markets, and has worked on 30+ closed deals (~US$ 14 bn cumulative deal size).

Archanaa started her professional journey with a short stint of 3 years in Kotak Commercial Banking (credit appraisal function) and is a Chartered Accountant by qualification with a Bachelor’s degree in Commerce and Law from Mumbai University.

Past Experience