ABOUT US

THE IREP STORY

Your Trusted Lender in the MSME Space

IREP Credit Capital is a Non-Deposit taking NBFC headquartered in Mumbai offering secured business loans to MSMEs in tier 3 and tier 4 towns.

IREP has established itself as a trusted lender in the retail lending space through its tailormade credit solutions to local entrepreneurs in the southern states of Andhra Pradesh, Telangana and Karnataka. IREP’s core offering is the IREP Secured Business Loan that is specifically crafted to cater to the immediate financial needs of relatively smaller sized businesses irrespective of the industry in which they operate. With a focus on quick, sustainable credit and last mile reach, IREP’s loans are targeted towards the largely underserved semi-urban and rural areas of the country’s financial system in order to empower local entrepreneurs realize their financial goals and make them ‘Atmanirbhar’. IREP’s long-term vision is to establish itself as a one-stop-shop for hassle-free credit solutions designed to meet the financial requirements of MSMEs.

Vision

To be a Partner in the growth of MSMEs in India by providing Secured Business Loans and Financial advisory services through technology-enabled platforms and robust processes with doorstep services

Mission

Endeavor to become an admired and respected financial advisory institution with high Corporate Governance, Ethics and Values

Values

- Entrepreneurship: Employees are trusted and empowered. At each level/location, employees are encouraged to take decisions in the best interest of the company and the business

- Teamwork: We operate as a team to achieve our common vision and goal.

- Risk Mitigation: As an organization, we are willing to assist customers who are Underserved, Underbanked, and Underpenetrated but Creditworthy, through the 3Cs approach.

- Customer Centricity: IREP is committed to following a customer-centric approach to serving the Shareholders & Regulators, Lending, Co-lending/Partners, Vendors, Agencies and IREO Employees. We are committed to being fair and transparent in our dealings with a ‘Customer First’ focus.

Objective

Our objective is to have full-fledged tech-based ‘PHYGITAL’ lending services targeting smaller towns focusing on the self-employed MSME segment – who is Unbanked, Underserved, Underpenetrated & NTCs but creditworthy, to provide Secured LAP with high-quality underwriting standards through robust processes to move towards financial inclusion, social responsiveness and customer delight with focus in women empowerment

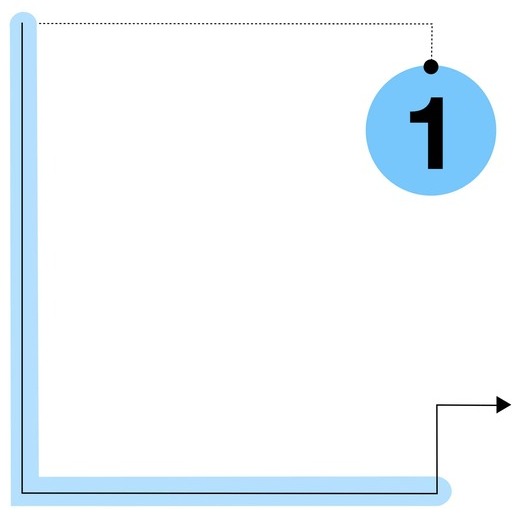

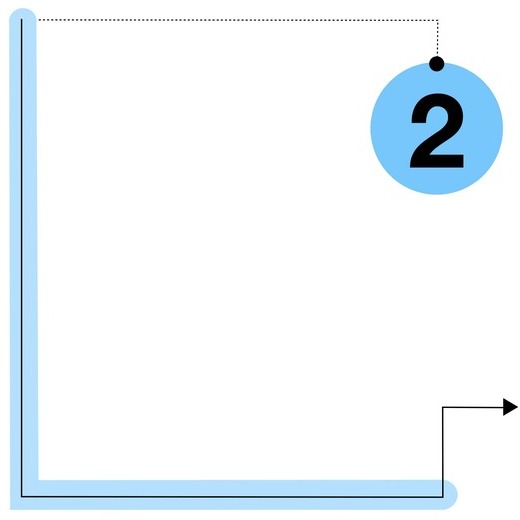

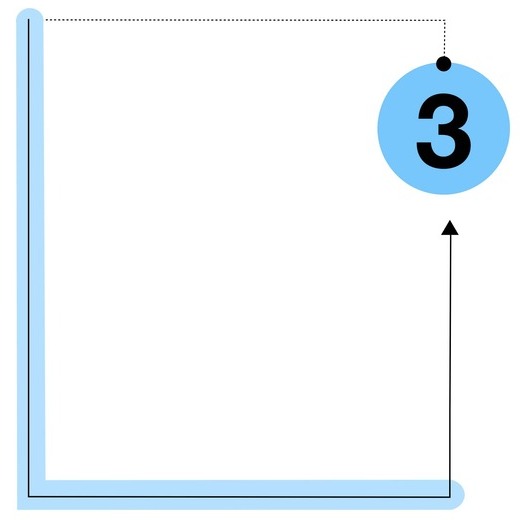

Branch Office Structure

- Personal discussion with each prospect by the Area Manager

- Site visit for due diligence of financial and operational aspects of each business by the CRO and the BM

- Third party independent Legal and Technical evaluation of each collateral

Hub office in Hyderabad

- Credit, Business and Operations head at Hyderabad reviews each file

- Any gaps are duly reconciled through seamless coordination with the branch offices

- Shortlisted files then sent to Mumbai for final approval

Head Office in Mumbai

- All pre-approved files are evaluated and reconfirmed by the team at Mumbai

- Final credit approval and loan disbursal is then initiated from IREP Bank Accounts via electronic transfer

MEET THE LEADERSHIP

Board Of Directors

Naresh Naik

CEO, IREP Credit Capital

Naresh serves as the Chief Executive Officer of IREP Credit Capital and has over 28 years of experience across financial services and real estate investments. Prior to this, Naresh was the Country Head of Morgan Stanley Real Estate Investing in India (MSREI).

He managed 7 investments totaling US$ 750 MM of equity with a total asset value of US$ 2,500 MM. He served on the Board of various portfolio companies including Oberoi Realty, Panchshil Realty, and Mantri Realty.

Prior to joining Morgan Stanley, Naresh worked with Lehman Brothers, based largely out of the US and for a couple of years out of India. In the US, he worked in various capacities across the Lehman Brothers Real Estate Funds’ North American and Indian portfolios.

He was also involved in creating the initial Asset Management infrastructure upon Lehman Brothers’ first venture into the real estate private equity space in 2001. In India, he was the head of Asset Management for Lehman Brothers Real Estate Partners (LBREP). He invested and managed over US$ 325 MM of equity investments.

Prior to that, Naresh lived in Goa, India, where he owned and operated his own architectural practice and real estate development company.

Naresh has graduated from the Goa University in India with a degree in architecture.

Robert Naso

Director, IREP Credit Capital

perience throughout the Asia Pacific and the United States and serves as a Director of IREP Credit Capital Private Limited.

He also serves as Managing Director and Founder of Clear Bridge Asia Capital (CBAC), wherein he works closely with real estate developers and operators across the Asia Pacific region in their capital, operational and investment planning/execution activities.

Prior to CBAC’s formation in 2012, Rob was most recently a Managing Director and Head of Asset Management for Morgan Stanley Real Estate Investing (MSREI) Asia Pacific, where he oversaw the group’s asset management activities in Mainland China, Hong Kong, Macau, India, Singapore/SE Asia, and Korea.

Rob also represented MSREI interests as a voting member of the Board of Directors in most transactions in the region.

Prior to joining MSREI, Rob spent 10 years with Prudential Real Estate Investors in their Newark, Short Hills, and Parsippany offices in New Jersey, USA.

Rob has a degree in Accounting from the University of Scranton and has done his MBA from Leonard N. Stern School of Business (New York University).

MEET THE LEADERSHIP

Strategic Advisors

Anil Jaggia

Strategic Advisor of the Firm

Anil is a highly respected and visionary leader in the Banking and Financial Services and Technology space with over 30 years of industry experience and serves as a Strategic Advisor to the Firm.

As an industry veteran, he currently advises and mentors a host of companies across various functions in the BFSI and IT sectors.

He most recently served as the COO for Avendus Capital where he led the Strategy, IT, Risk Management, Finance and Operations functions.

Prior to Avendus, he served as the CIO for HDFC Bank for over 7 years having played a key role in digital transformation of the bank. He undertook some key initiatives around Core Transformation, Data Warehouse, Analytics, Digital Banking and Business Continuity. He also led the Coordination Council for Financial Inclusion and Sustainable Livelihood Banking.

Anil also spent over 18 years with Citibank at their Chicago, New York, Singapore and India offices having led functions like Cash Management, International Trade, Foreign Exchange & Derivatives, Asset Sale and Commercial Cards.

Anil is a post graduate from IIM, Ahmedabad and an engineer from IIT, Kanpur, and brings with him a strong set of credentials and rich experience across financial services.

Pavan Kaushal

Strategic Advisor to the Firm

Pavan Kaushal is a seasoned professional with over 35 years’ experience in banking and financial services.

He has held senior leadership positions for over 25 years at IDFC Bank, Citibank, ANZ, and Fullerton India.

He currently serves as an advisor to Fullerton Financial Holding and ARCIL India.

He has extensive experience in managing large risk and operations roles across Large Corporate Banking, Commercial and Consumer Banking, NBFCs, Housing Finance at country, regional and International levels, across developed markets (U.K.) and emerging markets (India, Russia, Poland and Asia).

MEET THE LEADERSHIP

Senior Management Team

Sanjeev Verma

Deputy CEO

Sanjeev Verma is a seasoned business leader with over 30+ years of experience in Banking, Financial Services, and Insurance (BFSI). Specializing in MSME-Retail & Wholesale Secured funding, his career is marked by notable achievements in mortgage finance, secured lending, and MSME funding, coupled with an unwavering commitment to driving business growth.

As Deputy CEO of IREP Credit Capital, Sanjeev leverages his extensive expertise to propel the organization forward. With a proven track record in managing entire life-cycle of a customer in mortgage finance operations, securing MSME funding, and identifying growth opportunities across diverse markets across India, Sanjeev is poised to lead IREP Credit Capital to unprecedented success.

Sanjeev's visionary leadership style is characterized by his ability to transform innovative ideas into tangible results, optimize business productivity in the digital landscape, and solidify brand value using his Product Strategy knowledge with P&L ownership. He excels in executing strategies for multiple channels, digital tie-ups, and product launches while ensuring quality-driven business and delinquency management.

With a strategic vision, a flair for business innovation, managing large teams across the country and people management skills, Sanjeev Verma is driving IREP Credit Capital toward a future defined by growth, success, and empowerment.

In his previous stints, Sanjeev has been associated with Axis Finance, Yes Bank, ICICI Bank, IndusInd Bank, IDBI Bank, DHFL and Citibank; in various key strategic roles.

Basis overall experience and achievement, Sanjeev aims to transform IREP into a respectable and leading full-fledged tech-based Phygital lending service provider targeting smaller towns and the MSME segment – who are unbanked, underserved & NTCs but creditworthy, with high-quality underwriting standards through robust processes to move towards financial inclusion, social responsiveness and customer delight with women empowerment in mind.

Ramchandran N

Chief Collections Officer, IREP Credit Capital

N. Ramachandran serves as the Chief Collections Officer at IREP Credit Capital and brings with him over 30 years of multi-faceted experience in financial services, specializing in

Prior to joining IREP, Ramachandran held leadership roles at several reputed financial institutions including Muthoot Finance Ltd., where he served as Chief Collections Officer, SBFC Finance Pvt. Ltd, Bajaj FinServ Ltd, HDFC Bank, and GE Countrywide Consumer Financial Ltd. Over the course of his career, he has developed a strong track record of translating strategic business goals into operational excellence, particularly in the areas of debt management and collections.

Ramachandran is recognized for building high-performing teams and deploying robust collections strategies that have consistently delivered results in high-volume, performance-driven environments. His approach integrates both risk mitigation and customer-centric recovery models, underpinned by a deep understanding of retail finance.

He holds a Post Graduate Diploma in Business Administration and is a graduate in Commerce. He has also completed the Summer School Program on Management Development from the prestigious Indian Institute of Management – Ahmedabad.

At IREP, Ramachandran is responsible for strengthening the company’s collections framework, aligning operational efficiencies with business growth, and reinforcing the company’s commitment to sustainable retail lending.

Bhavesh Patel

Chief Operating Officer, IREP Credit Capital

Bhavesh Patel serves as the Chief Operating Officer at IREP Credit Capital, bringing with him over 33 years of experience in retail lending operations and large-scale team leadership across India’s financial services sector.

Before joining IREP, Bhavesh held the position of Chief Operations Officer at Sewa Grih Rin Ltd., where he was responsible for overseeing end-to-end loan operations and optimizing branch-level efficiencies. A large part of his career was associated with ICICI bank as Head- Retail loan operations across all retails loan products, where he played a critical role in building scalable operational frameworks and driving customer-centric process improvements. He also served as a consultant at Jio Finance, where he played a pivotal role in designing and implementing end-to-end digital processes for loan operations and customer service.

Bhavesh holds a Bachelor’s degree in Commerce from the University of Gujarat. Throughout his career, he has been known for his pragmatic approach to operations, hands-on leadership style, and deep understanding of rural and semi-urban lending ecosystems.

At IREP Credit Capital, Bhavesh is focused on strengthening operational governance, enhancing turnaround times, and enabling seamless credit delivery across the company’s growing footprint.

Manmohan Shetty

Chief Financial Officer

Manmohan joined IREP in February 2016 and heads the Finance function.

He is a qualified Chartered Accountant and seasoned banking & finance professional with over 17 years of work experience.He has managed responsibilities of legal entity control, regulatory reporting, audits, financial planning & analysis, capital planning, treasury governance, project management, and tax compliances for various business entities like banks, NBFCs, securities broker-dealers, etc.

Prior to joining IREP, Manmohan worked in the Finance team at Barclays Bank Plc, India branches.

He was also the CFO of Barclays Investments & Loans India Limited, the NBFC arm of the Barclays Group in India and his work experience also includes a stint at Lehman Brothers (India).

Ashok Mali

Chief Technology Officer, IREP Credit Capital

Ashok Mali serves as the Chief Technology Officer at IREP Credit Capital, bringing over 22 years of diverse experience in technology leadership across the financial services sector. Based at the company’s Corporate Office, Ashok spearheads the digital and technology strategy to drive innovation, efficiency, and transformation across IREP’s operations.

With deep expertise in business process automation, transformation, and solution architecture, Ashok has successfully led implementations of a wide range of core systems including multiple Retail LOS platforms, Corporate LOS, Core Banking Platforms like TCS BaNCS, FinnOne, SAP R3, Credence and also worked on BRE implementation, Data Ware House related IT initiatives, Customer portals, and API integration platforms.

Ashok has held leadership roles at renowned organizations such as Piramal Capital & Housing Finance, Hexaware Technologies, and Tata Capital. Most recently, he served as Chief Information Officer at Tata Capital Housing Finance.

He holds an MBA in Marketing and a Bachelor's degree in Chemical Engineering. Additionally, Ashok has completed executive education in IT Project Management from IIM Ahmedabad and a leadership program from XLRI Jamshedpur. He is a certified PMP, ITIL V3, and Six Sigma Green Belt professional

Satish Kumar N

National Credit Manager – South IREP Credit Capital

Satish Kumar N serves as the National Credit Manager – South at IREP Credit Capital and brings over 16 years of extensive experience in credit risk management across the retail lending space. Based in Bangalore, he is responsible for driving credit quality, portfolio health, and risk mitigation strategies across IREP’s southern markets.

Satish has deep expertise in assessing creditworthiness, implementing risk frameworks, and ensuring regulatory compliance. He has led the development of robust credit policies and models, with specialization in retail lending products including LAP loans, Affordable LAP, Business Loans, and Personal Loans.

Prior to joining IREP, Satish held leadership positions at NeoGrowth Credit Pvt Ltd, where he served as Circle Credit Head for South and East. His career includes significant stints at leading financial institutions such as Yes Bank, RBL Bank, Standard Chartered Bank, Barclays Finance, Magma Fincorp Ltd., HDB Financial Services, and Unimoni Financial Services Ltd.

Satish holds an M.B.A. in Finance and a Bachelor's degree in Commerce.

Srimoyee Kar

Senior Vice President, Treasury

Srimoyee has over 18 years of experience in managing NBFC Treasury operations.

Her experience includes Asset Liability Management, ALCO, resource raising from debt capital markets and banks, treasury operations, and managing investor relationships.

Prior to joining IREP Credit Capital, she was in charge of the Treasury at India Infoline Limited and also had a stint with Bank of America Merrill Lynch in the Treasury department.

She is a qualified Chartered Accountant and completed her articleship at PricewaterhouseCoopers. She holds a Bachelor’s Degree in Commerce from Narsee Monjee College of Commerce & Economics, Mumbai.

Kaustubh Tallur

Vice President, Investor Relations & Reporting

Kaustubh Tallur is presently in charge of the Investor Relations & Reporting division. After more than four years at IREP, Kaustubh played a key role in the formation of the investor relations team and contributed a substantial contribution to a variety of tasks involving corporate finance, investor relations, strategy, analytics, and financial modeling. At the corporate level, he is vital in developing annual business strategies, product policies, and important strategic initiatives.

Prior to IREP, Kaustubh was part of the Investment Banking Coverage Team for Infrastructure at JM Financial for ~3 years and worked extensively on capital market and M&A transactions. Prior to JM, Kaustubh worked with Citigroup’s investment banking team, where he was involved in multiple domestic and cross-border transactions. Kaustubh has completed his post-graduation from KJ Somaiya and holds a graduate degree from Mumbai University.

Satyanarayana Koneti

Vice President - State , Business Head - AP & Telangana

Satyanarayana Koneti is a dedicated business leader with over 14 years of experience in business management, marked by his strategic vision and commitment to excellence. As the Vice President - State Business Head for AP & Telangana at IREP Credit Capital, Satyanarayana has demonstrated exceptional skills in expanding branch networks, driving business growth, and maintaining high portfolio quality.

Satyanarayana’s career began at in the NBFC space, where he quickly rose through the ranks from a Relationship Officer to Divisional Manager. His ability to increase the branch network significantly and achieve outstanding cross-selling awards laid a solid foundation for his future endeavors.

At IREP Credit Capital, Satyanarayana leverages his extensive experience to identify market opportunities, improve operational efficiencies, and maintain a high standard of portfolio management. His leadership is characterized by his ability to work under pressure, inspire his team, and achieve exceptional results.

Dipika Nandy

VP Human Resources

Dipika Nandy is an expert HR professional with a 17+ years’ experience in the Human Relations domain. She has a demonstrated managing and supervising a large set of employees across the country. Dipika is known for her hands-on approach in creating and continuously improving HR processes, thus ensuring a balance between organizational priorities, market realities, and stakeholder sensitivities.

Dipika's previous roles include senior positions in Poonawalla Fincorp, Bajaj Finance and Yes Bank. Throughout her career, She has demonstrated her ability to drive initiatives that benefit both the organization and the employees, making her a perfect contributor for IREP.

Phanirajkumar Rangepalli

Head Operations

With over two decades of professional expertise in operations, credit, and audit management, R. Phani Raja Kumar serves as the VP and Head of Operations at IREP Credit Capital. He has extensive experience in the domain of fraud recovery, warehouse management, and the adoption of SAP and Newgen LOS/LMS.

He has expertise in process execution, branch operations, and team leadership owing to his prior positions at ICICI, Tata Motors Finance, SREI Equipment Finance, and Equitas Small Finance Bank.

R.Phani Raja Kumar is instrumental in handling IREP Credit Capital's Head of Operations